What is skimming? How to protect yourself against it?

Cashless transactions are becoming commonplace, and methods of data theft are evolving, becoming increasingly sophisticated. One such method is skimming – a technique involving the illegal copying of payment card data without the owner's knowledge. How can you protect yourself from it? Discover the answer to this important question.

What is skimming and what are its methods?

Skimming is a type of electronic data theft involving the illegal copying of information from the magnetic stripe of a payment card using a special device called a skimmer. This technique is often used on ATMs, payment terminals in stores, or gas stations, where thieves install skimmers to capture credit and debit card data from users.

Skimming can also involve the theft of data from cards equipped with contactless technology (RFID). In such cases, criminals use portable readers to remotely scan cards. Skimming methods are evolving to include advanced techniques such as a hidden camera near the ATM keyboard that records users entering their PINs or malware installed in payment terminals that captures data during transactions. If you are interested in these practices, be sure to stay with us and read about the real-life scenarios of skimming in everyday life and how you can defend against them. The good news? With a bit of caution and prudence, you can effectively secure your finances.

Anti-skimming technologies and how they work

In response to the growing threat of skimming, a range of anti-skimming technologies have been developed to protect users and their financial data. One of the most popular methods is the use of so-called jammers, which are devices installed in ATMs or payment terminals that interfere with skimmers' ability to capture card data.

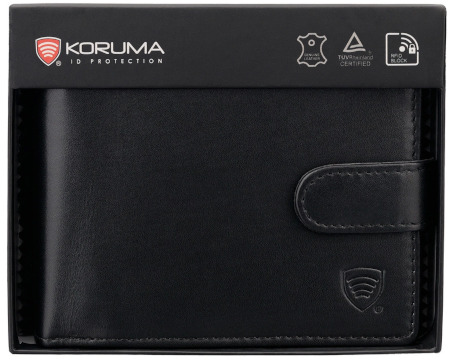

Another technology is the use of special covers on the card slot, making it difficult to install a skimmer. Additionally, many modern payment cards are equipped with chip technology (EMV), which is much harder to copy than a traditional magnetic stripe. It is also advisable to purchase special RFID wallets or cases that block radio signals, preventing unauthorized remote scanning. Contemporary anti-skimming technologies are constantly being improved to stay ahead of the methods used by criminals.

Tips on how to protect yourself from skimming

Protecting yourself from skimming requires taking conscious actions in both the physical and digital realms. The simplest methods include regularly monitoring your expenses and checking bank statements for unauthorized transactions. It is also important to use RFID-protected wallets, which block remote card scanning. When using ATMs or payment terminals, it is advisable to cover the keypad while entering your PIN to prevent it from being recorded by a hidden camera. It is also wise to choose devices located in safe, well-lit areas and avoid those that look modified or damaged. If using contactless cards, consider disabling this function.

Real scenarios of skimming

Skimming can take many forms and involve various everyday situations, making it particularly dangerous. One of the most common scenarios is the installation of skimming devices on ATMs. Thieves mount fake panels or card readers that look almost identical to the machine's original components. Another example is the use of portable skimmers by individuals handling payments in restaurants or stores, who dishonestly copy customers' card data during transactions. Skimming also takes the form of phishing – using fake websites or emails to trick users into providing their card information. Understanding these scenarios and using payment cards and ATMs consciously is key to preventing data and financial theft.

Protecting yourself from skimming requires vigilance, but also knowledge of how thieves operate and what preventive measures you can take. Regularly monitoring transactions, using RFID-protected wallets, employing virtual payment cards, and changing PINs are just some methods that can significantly increase your security. In the fight against cybercrime, knowledge and prevention are our strongest allies. We hope that our guide will help you properly secure yourself against attacks.